RECENT SEARCHES

TRENDING SEARCHES

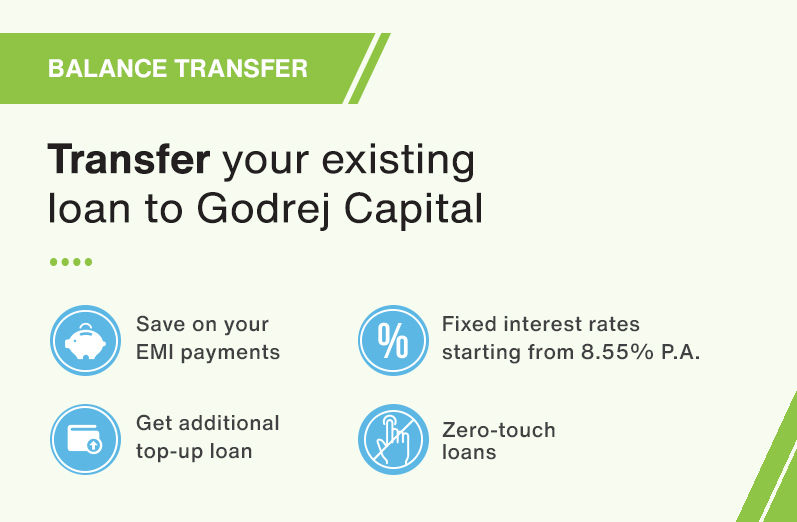

- Key Benefits

- Interest Rates

- Calculators

- Documents Required

- FAQs

Key Features

- Key Benefits

- Lower your EMI payments with interest rates starting from 8.55%

- Avail additional Top-Up loans for your home and personal needs

- Get quick sanction and disbursal with minimum documentation

*T&C Apply

RESIDENT

Salaried

NON-RESIDENT INDIAN

Salaried

BUSINESS

Self Employed

PRACTICING PROFESSIONALS

Self Employed

*T&C Apply

- Balance Transfer

- Emi Amount

- Loan Eligibility

- Tax Saving

Existing Loan

Proposed Loan

Total saving in cash outflow

Savings In EMI

Proposed EMI

Existing EMI

Your Monthly EMI

₹

For the year at the % of interest rate

Total Interest Payable

₹

Total Payment (Interest + Principal)

₹

Your EMI Will Be

₹

Your Eligibility

₹

Financial Details

Income Tax Benefits

₹

Income Tax Payable includes 4% cess.

Income Tax Payable After Loan

₹

Income Tax Payable Before Loan

₹

Documents Just what is needed. Nothing more.

- Salaried

- Self-Employed

- Practicing Professional

- Pan Card or Form 60

- Copy of proof of identity (Aadhar number / Valid Passport / Valid Driving License / Voter’s Identity Card)

- Copy of proof of address (Aadhar number / Valid Passport / Valid Driving License / Voter’s Identity Card)

- Copy of salary slip for last one month, or a Salary Certificate on the company letterhead (authorized by the signatory of the organisation)

- Copy of proof of employment for last 2 years (Form 16 or joining date on appointment letter or salary slip)

- Copy of salary account statement for last 6 months

- Copy of proof of bonus for last 2 years (bank statement) or variable incentive for last 6 months(salary slip)

- Copy of bank statement reflecting EMI clearance of Last 6 EMIs OR Statement of account

- Copy of sanction letter as evidence of the collateral address

- Customer declaration for outstanding loan and list of submitted documents

For Under construction Home Loans – Approved Projects

- Copy of allotment letter or stamped agreement for sale

- Copy of payment receipts Payment Receipts or bank account statement showing all payments made to the builder

For Resale Home Loans

- Copy of current Registration or Draft Agreement for sale (only for Maharashtra) /allotment letter

- Copy of Occupancy Certificate (fully constructed property) or approved plan copy (photocopy of the blueprint)

- Copy of Share Certificate (only for Maharashtra), maintenance bill, property tax receipt

- Copy of payment receipts or bank account statement showing payments made to seller

- Prior Chain Link title documents

- Pan Card or Form 60 is a mandatory requirement for the loan application processing

- Proof of identity (Aadhaar number/ Valid Passport/ Valid Driving License / Voter's Identity Card)

- Proof of Address (Aadhaar number/ Valid Passport/ Valid Driving License / Voter's Identity Card)

- ITR and Financial statements including P&L, Balance Sheet, COI & Schedules - 2 Years - certified by a Chartered Accountant

- Bank Statements for last 12 months

- Business Continuity Proof for 5 years

- Tax Audit Report, if applicable

- Bank statement reflecting EMI clearance of Last 6 EMIs OR Statement of account

- Sanction letter to evidence Collateral address

- Customer declaration for - Loan outstanding & List of documents submitted.

For Under construction Home Loans – Approved Projects

- Allotment Letter or Stamped Agreement for Sale

- Payment Receipts or bank account statement showing all payments made to the Builder

For Resale Home Loans

- Current Registered or Draft Agreement for Sale (only for Maharashtra) or Allotment Letter or Stamped Agreement for Sale

- Prior Chain Link title documents

- Occupancy Certificate (in case property is ready) or Approved Plan copy (Xerox Blueprint)

- Share Certificate (only for Maharashtra), Maintenance Bill, Property Tax Receipt

- Payment Receipts or bank account statement showing all the payments made to Seller

- Pan Card or Form 60 is a mandatory requirement for the loan application processing

- Proof of identity (Aadhaar number/ Valid Passport/ Valid Driving License / Voter's Identity Card)

- Proof of Address (Aadhaar number/ Valid Passport/ Valid Driving License / Voter's Identity Card)

- ITR and Financial statements including P&L, Balance Sheet, COI & Schedules - 2 Years - certified by a Chartered Accountant

- Practice Continuity Proof for 5 years

- GST challans for last 1 or 2 or 3 quarter since filing of last returns

- Tax Audit Report, if applicable

- Bank statement showing Rental credits & Registered Rent Agreement, if applicable

- Bank statement reflecting EMI clearance of Last 6 EMIs OR Statement of account

- Sanction letter to evidence Collateral address.

- Customer declaration for - Loan outstanding & List of documents submitted.

For Under construction Home Loans – Approved Projects

- Allotment Letter or Stamped Agreement for Sale

- Payment Receipts or bank account statement showing all payments made to the Builder

For Resale Home Loans

- Current Registered or Draft Agreement for Sale (only for Maharashtra) or Allotment Letter or Stamped Agreement for Sale

- Prior Chain Link title documents

- Occupancy Certificate (in case property is ready) or Approved Plan copy (Xerox Blueprint)

- Share Certificate (only for Maharashtra), Maintenance Bill, Property Tax Receipt

- Payment Receipts or bank account statement showing all the payments made to Seller

*Disclaimer: All contents mentioned on this page, including but not limited to documents, eligibility may vary for each borrower and are subject to the discretion of the lender. The content is subject to change without prior notice.

FAQs

- Balance Transfer

- Top-Up

- Insurance Related

Balance Transfer is a financial strategy that allows you to move an existing loan from one lender to another, typically with the aim of securing better terms, such as lower interest rates or more favorable repayment terms. Godrej Capital's Balance Transfer empowers you to shift your outstanding loan to us, providing opportunities for reduced EMI payments, competitive interest rates, and enhanced financial flexibility. It's a smart move to optimize your loan and achieve greater savings in the long run.

Click here to apply online

Home Loan Balance Transfer is a process where you transfer your existing home loan from one lender to another. This strategic move enables you to benefit from lower interest rates, reduced monthly payments, and improved loan terms. By choosing Godrej Capital for your Home Loan Balance Transfer, you unlock the advantages of our competitive interest rates, additional Top-Up loans, and a simplified documentation process. It's a financial decision that empowers you to optimize your home loan for better savings and flexibility.

Click here to apply online

Transferring your home loan balance to Godrej Capital through our efficient balance transfer procedure unlocks various benefits. Enjoy competitive interest rates, EMI savings, and the flexibility to extend the repayment period. Plus, experience the advantage of a higher loan amount, including a Top-Up loan, tailored to meet additional requirements.

We keep the Balance Transfer procedure simple and hassle-free. Once you apply for a Home Loan Balance Transfer with Godrej Capital, you can expect a swift 7-day processing period. After applying for the balance transfer process online on our website, our representative will contact you for necessary documents, including those required for eligibility assessment. You can simply click here to apply for Balance Transfer.

There's no maximum limit for the transfer amount. If eligible, Godrej Capital allows the complete transfer of your Home Loan outstanding balance, ensuring a seamless process.

Certainly! At the time of the balance transfer, self-employed individuals can extend the repayment tenor to up to 20 years, while salaried customers can extend the loan tenure to up to 30 years. The extension is subject to the borrower’s eligibility and age.

No, there is no mandatory requirement to provide a guarantor. The eligibility for a Home Loan Balance Transfer is simple. However, it may change, subject to alternations in the internal policies of the lender.

The National Automated Clearing House (NACH) mandate simplifies loan repayment by providing a centralized and efficient clearing platform. Godrej Capital utilizes the NACH debit mandate to automatically deduct monthly instalments from your bank account, ensuring a hassle-free repayment process.

There are two ways to cancel your NACH mandate:

You can log in to the Customer Portal and request to cancel the mandate through the ‘Write to Us’ section.

You can also send an email to customercare@godrejcapital.com through your registered email ID or call our Customer Care +91 22 68815555 through your registered mobile number and place a request for NACH mandate cancellation.

Please note that you need to mention the Loan Account Number (LAN) in the request, and our team will connect with you within 48 hrs.

Top-Up Loans can tend to personal and professional needs like home furnishing, marriage, child's tuition business expansion, etc.

Customers opting for a Balance Transfer of their Home loan can additionally avail of a top-up loan from Godrej Capital subject to meeting the qualifying criteria.

You can avail a top-up loan for a maximum term of 15 years

As a Top-Up Loan is a primarily a new loan, standard processing fees apply to it as well.

No, it is not mandatory to obtain Insurance. However, Insurance is a voluntary risk mitigation device that helps customers in multiple ways, such as securing the asset, helping in paying off the loan liability in an unlikely event.

The insurance contract is between the Insurer and the customers. The company plays a limited role in facilitating the insurance contract between customers and Insurers. It will be the Insurer's responsibility to provide details and benefits to the customers.

Loan-linked Insurance covers a large amount of the loan liability. In any unforeseen circumstances like death, disability, hospitalization, and diagnosis of critical ailments, the Insurer can repay the loan liability through Insurance.

Credit-Life Insurance provides death cover for natural, accidental, and unnatural cause deaths. It also includes coverage for death due to Covid-19 and can be extended to co-borrowers. Customers can also avail the benefit of Section 80-C Income Tax deduction.

Survival-Benefit Plan is for critical illness insurance and provides additional cover for medical emergencies like heart attack, stroke, or cancer. Because these emergencies or illnesses often incur greater than average medical costs, these policies pay out cash to help cover those overruns where traditional health insurance may fall short. These policies come at a relatively low cost. However, the instances that they will cover are generally limited to a few illnesses or emergencies.

Health insurance aims to provide a defence against the hardship caused due to lack of income because of (a) Disease, (b) Accident, (c) Surgery and (d) hospitalization.

Property Insurance secures the property for which the loan has been availed; ensures the security of valuables within the house. It is applicable for entirely constructed property wherein the customer has possession of the property. The Claim amount is the reinstatement value of the property.

Other Products

Stories in Focus - The Blog

Company is a Master Policy Holder and facilitates the products of above insurance company on purely voluntary basis as a risk mitigation measure.